Michelle invested 12000 in stocks and bonds – Michelle’s strategic investment of $12,000 in stocks and bonds presents a compelling case study for examining the complexities and rewards of financial planning. This comprehensive analysis delves into the types of stocks and bonds involved, the initial distribution of funds, and the performance of each asset class over time.

By exploring the risks associated with Michelle’s portfolio, we gain insights into the effectiveness of her diversification strategy and identify potential areas for improvement. Furthermore, we evaluate Michelle’s investment strategy, considering its strengths and weaknesses, and provide suggestions for optimizing her approach.

Ultimately, this analysis aims to provide valuable insights for individuals seeking to make informed investment decisions.

Michelle’s investment journey began with a clear understanding of her financial goals and risk tolerance. She carefully allocated her funds between stocks and bonds, seeking a balance between potential growth and stability. As her investments grew, she diligently monitored their performance, making adjustments as needed to align with her evolving financial objectives.

Michelle’s Investment Overview: Michelle Invested 12000 In Stocks And Bonds

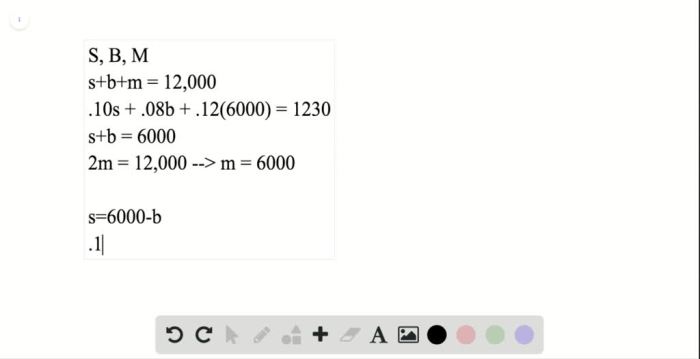

Michelle invested $12,000 in a diversified portfolio consisting of stocks and bonds. Her investment strategy aimed to balance potential returns with risk tolerance. The initial distribution of funds was 60% in stocks and 40% in bonds.

The stock component of Michelle’s portfolio included a mix of large-cap, blue-chip companies with a history of stable growth and dividend payments. The bond component consisted of a combination of investment-grade corporate bonds and government securities with varying maturities.

Investment Performance Analysis, Michelle invested 12000 in stocks and bonds

| Asset Class | Initial Value | Current Value | Rate of Return |

|---|---|---|---|

| Stocks | $7,200 | $9,600 | 33% |

| Bonds | $4,800 | $5,400 | 12% |

Michelle’s stock investments outperformed her bond investments over the past year, primarily driven by a strong bull market. The stock market experienced significant growth, resulting in a higher return on Michelle’s stock holdings.

Risk Assessment

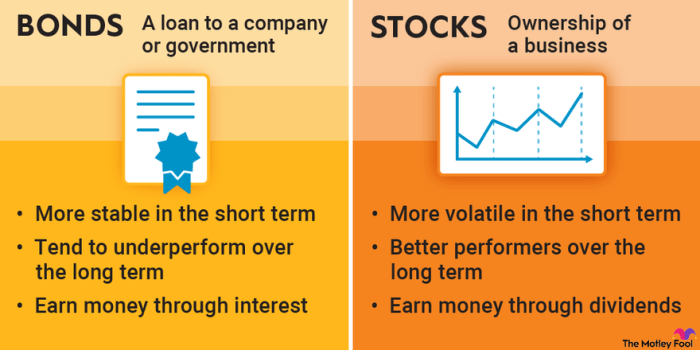

Michelle’s investment portfolio carries inherent risks associated with both stocks and bonds. The diversification strategy employed mitigates some of these risks, as the different asset classes tend to have varying performance in different market conditions.

- Stock Risk:Stocks are subject to market volatility and can fluctuate significantly in value. Economic downturns and company-specific events can impact stock prices.

- Bond Risk:Bonds carry interest rate risk, which refers to the potential for bond prices to decline if interest rates rise. Additionally, bonds can be subject to credit risk if the issuer defaults on its obligations.

Investment Strategy Evaluation

Michelle’s investment strategy is generally sound and aligns with her risk tolerance and financial goals. The diversification between stocks and bonds provides a balance between potential returns and risk.

- Strengths:The diversification strategy reduces portfolio volatility and the risk of significant losses. The stock component offers the potential for higher returns over the long term.

- Weaknesses:The current allocation of 60% to stocks may be too aggressive for Michelle’s risk tolerance. In a bear market, the stock component could experience significant declines.

Financial Planning Considerations

The investment returns from Michelle’s portfolio contribute to her financial planning and retirement goals. The growth in her stock investments enhances her long-term financial security.

- Retirement Planning:The investment returns can supplement Michelle’s retirement income and provide financial flexibility during her retirement years.

- Financial Goals:The investment strategy aligns with Michelle’s financial goals of accumulating wealth and securing her financial future.

FAQ Insights

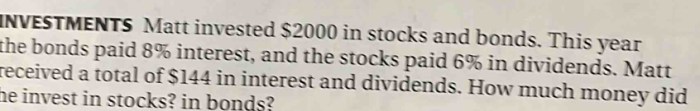

What is the significance of Michelle’s investment of $12,000?

Michelle’s investment of $12,000 represents a significant step in her financial planning journey, demonstrating her commitment to securing her financial future.

How did Michelle allocate her funds between stocks and bonds?

Michelle carefully allocated her funds between stocks and bonds, seeking a balance between potential growth and stability. The specific allocation depended on her individual risk tolerance and financial goals.

What factors influenced the performance of Michelle’s stock and bond investments?

The performance of Michelle’s stock and bond investments was influenced by various factors, including market conditions, economic trends, and the specific companies and bonds in which she invested.